Leaders in Mortgage Securitization

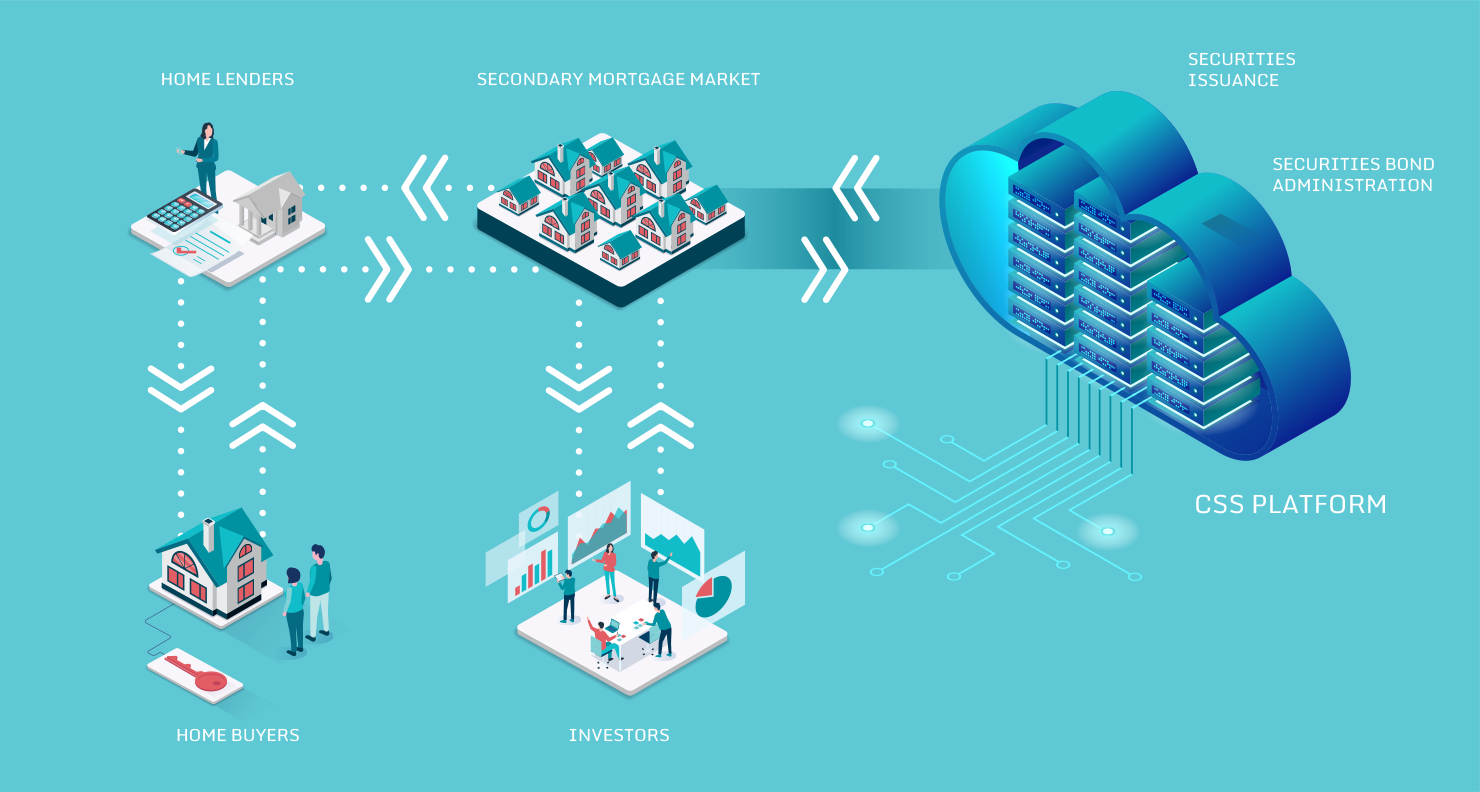

Supporting the bedrock of the American economy – the secondary mortgage market – CSS is a client-centric, collaborative, and innovative team of experts who creatively develop technological solutions for the industry’s complex challenges.

Who We Are

Our Impact

What We Do

To replenish their funds, so more people can buy homes, lenders sell or swap the mortgages on their books for securities through the secondary market.

1 of 7CSS administers the transition of individual mortgages into mortgage-backed securities. Once issued, investors can purchase MBS for their portfolios, like a stock or bond. The purchase of MBS by investors creates liquidity that enables lenders to issue new home loans, allowing more people in the United States to realize their dream of owning a home.

2 of 7

Securities Issuance

CSS creates and registers securities with the Federal Reserve, and then settles those securities between GSEs and depository institutions.

CSS facilitates settlement of mortgage securities for Fannie Mae and Freddie Mac.

3 of 7

Securities Bond Administration

CSS facilitates securities tracking and calculates payment factors to investors in addition to creating the payment files to direct payments from the paying agent to investors. CSS calculates and discloses security level tax factors, generating annual and quarterly tax forms to investors and the IRS ensuring accuracy and completeness for all parties. CSS generates all required disclosures and loan-level information for securities issued through the platform, helping investors make buy and sell decisions.

CSS manages mortgage-backed securities on its cloud-native background.

4 of 7Government-sponsored enterprises (GSEs) buy mortgage loans from lenders or facilitate the lender packaging them into securities called Mortgage-Backed Securities (MBS), which are then created and issued by CSS.

5 of 7 Lenders facilitate the home buying process by providing mortgages to borrowers. 6 of 7Investors can purchase MBS for their portfolios like a stock or bond. Additionally, investors use data outputs from CSS to better understand their transactions.

7 of 7

To replenish their funds, so more people can buy homes, lenders sell or swap the mortgages on their books for securities through the secondary market.

2 of 7CSS administers the transition of individual mortgages into mortgage-backed securities. Once issued, investors can purchase MBS for their portfolios, like a stock or bond. The purchase of MBS by investors creates liquidity that enables lenders to issue new home loans, allowing more people in the United States to realize their dream of owning a home.

3 of 7 CSS creates and registers securities with the Federal Reserve, and then settles those securities between GSEs and depository institutions. CSS facilitates settlement for an average of 11,000 transactions per month that equates to 6,000 securities with $380 billion in unpaid principal 4 of 7 CSS facilitates SEC-level tracking and calculates securities payment factors to investors and creates payment files to direct payments from the paying agent to investors. CSS calculates and discloses security level tax factors, generating annual and quarterly tax forms to investors and the IRS ensuring accuracy and completeness for all parties. CSS generates all required disclosures and loan-level information for securities issued through the platform, helping investors make buy and sell decisions. CSS manages 1 million securities on its platform 5 of 7 Government sponsored-enterprises (GSEs) buy mortgage loans from lenders or facilitates the lender packaging them into securities called Mortgage-Backed Securities (MBS), which are then created and issued by CSS. 6 of 7Investors can purchase MBS for their portfolios like a stock or bond. Additionally, investors use data outputs from CSS to better understand their transactions.

7 of 7How We Think

- TOPIC: Innovation

Neil Hunt

Director - Cloud Solutions Architecture

October 26, 2023

Case Study

- TOPIC: Data Sharing

- TOPIC: Mortgage Forbearance

Akbar Hamid

VP - Innovation and Architecture

December 31, 2020

Case Study

- TOPIC: Market Trends

Lea Laman

SVP - Client Services and Operations

December 31, 2021

Case Study

What Our Clients Say About Us

“CSS is very responsive and fully engaged with us as partners. Employees are interested in their work and in trying to figure out how to improve processes and results.”

“This is an example of a great partnership.”

“CSS is very proactive and there is excellent communication between CSS and [its clients].”

“CSS has a strong track record of successful operational Service Level Agreement execution.”